NEW! Children's Fitness Tax Credit Receipt Upgrade Parents and Club Administrators will be happy to know that Zone4 has upgraded the system for issuing Children's Fitness Tax Credit Receipts. The new upgrade will benefit Parents in that they will receive their Tax Receipt at the time of Registration, which will avoid them having to wait for it to be issued during tax season, or having to hunt it down long after they have registered their child for a fitness program. Club Administrators will no longer have to spend their valuable time creating and issuing Tax Receipts for the children's programs their Club offers, as the Zone4 System will automatically generate them and email a PDF link to the Registrant. **If you would like to allow for the New Children's Fitness Tax Receipts to be sent, please include this feature when you Create your registration For Club Administrators, the key to using the Childrens' Fitness Tax Credits Receipt System, is to set up the Tax Credit Amount at the time when your program registration is being created. First you must identify and weight which programs your organization is offering that would qualify as a Tax Credit. Please refer to the Canada Revenue Agency (CRA) website http://www.cra-arc.gc.ca/fitness/ for more information regarding what qualifies for the Tax Credit program. It is the Organization's responsibilty to determine which of the programs you offer are appropriate to issue a Tax Receipt. It is also the responsibility of the Parent to correctly identify whether they are eligible to claim the amount. **Please note that a Club "Membership" may not qualify as Fitness "Program". CRA Information for Organizations Providing Prescribed Programs of Physical Activity Link Here: http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns360-390/365/rgnztns-eng.html Children's Fitness Tax Credit Eligibility Checklist Link Here: http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns360-390/365/chcklst-eng.html

Once the Program has been identified as suitable, Club Administrators must also determine what percentage of the Program's Fees qualify as a Tax Credit. In most cases, 100% of the fee will qualify, however, occasionally because of how some Clubs like to set up their fee structure only part of the fee would be available for the Credit. If you have a program with a Family Pricing, for example, you would have to determine what percentage of that Family Fee would be allowed for the Child's Fitness Tax portion. Zone4 allows for this flexilbility in your pricing by enabling Club Administrators to choose the percentage weight of each of your programs. For the following Program Registration, the 'Family Registration' will only have part of the fee available for Tax Credits, but the 'Junior Training Program' and' Children's Jackrabbits' would have the entire fee available. The 'Adult Lessons' would not qualify, and therefore none of the fee would be available.

How to Set Up the Children's Fitness Tax Credit within your Registration: Most registrations would have the fee section in the 'Individual Fields" area of the form because most program fees are associated with each Individual Registrant. However, if you would like your fees to be placed in the "Cart Fields" area of your form to allow for Family and other special fee options, then it is still possible to place them there and use the Tax Receipt function. To set up the Tax Receipt portions, first go to one of the Common Fee Fields such as the "Single Choice Fee Group" to set up the Fees for your Programs.

List the Programs and Prices your organization is offering as Options in this Field. Use the Grey Slide Bar at the bottom to slide to the right where more Optional Settings are available.

The % Tax Credit Option can be found to the right of each Program Option. Decide what percentage Tax Credit would be allowed for that program and enter it here. In this example, the Family Registration allows 50% for the fee to be applied to the Tax Credit, while the Children's Programs are entitled to 100% of the fee. The Adult program does not count for a Tax Credit and therefore is set at 0% or left blank is fine.

You can place the % Tax Credit amount in the Fee Option field as well:

Please Note: You must also include a "Date of Birth"Field within your registration. CRA requires that the Date of Birth be listed on the Tax Receipt. Now that the % Tax Credit is set up, whenever someone registers for a Club program, upon Checkout, they will receive an emailed Receipt for that registration. At the bottom of that emailed receipt, there will be a link to a PDF of their Children's Fitness Tax Credit Receipt. A Parent can click on that link anytime to download their PDF Tax Receipt. This PDF Tax Receipt is formatted in the manner that the Canada Revenue Agency requests, including all of the infomation the CRA needs. Also, if there have been changes made to the registration after the Checkout is complete, those changes will be reflected in the Tax Receipt. Changes will automatically update in the PDF link, and a Parent can simply download a new version if needed.

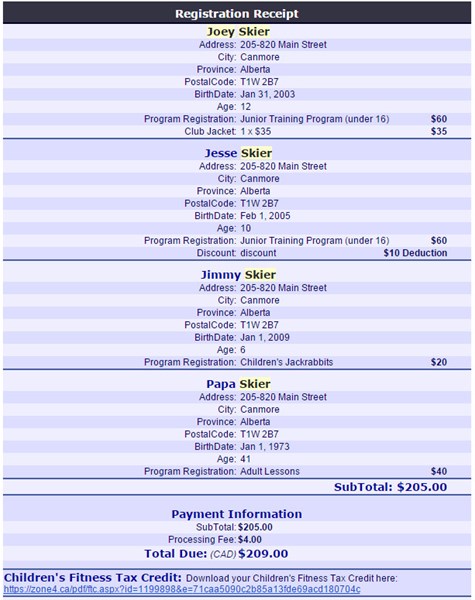

The link will go to one PDF Receipt which will include all the eligible Children that are registered in that particular Cart. If a Parent has registered more than one Child into qualified programs, then each of those children will be listed on separate pages of the PDF receipt. If you place Discounts or Negative fees onto your Registration form, the Tax Receipt Credit will be calculated factoring in those discounts. If there are added fees for items such as Club clothing, that do not qualify for the Tax Credit, they will not be included on the Tax receipt. Here is an example of a receipt with a few different choices for each person registered. You can see the link to the Children's Fitness Tax Credit at the bottom of the receipt:

When you click on the link, the PDF Receipt looks like this with each child listed on a separate page:

|

Copyright 2024 - Zone4 Systems zone4.ca Privacy Policy Delivery/Refund Policy Terms of Service Contact Zone4